After witnessing the unchecked increases of healthcare costs in the early 2000’s, I admit to being one of the many doctors who jumped on the bandwagon of healthcare reform being touted by politicians back in 2008.

I was fully aware that something drastic needed to be done because I personally participated in a system that was the leading cause of bankruptcy in the country. I vividly recall one of my patients who needed a CT scan asking me how much it would cost and answering, “I’m not sure, but probably a few hundred bucks I’d guess.”

Several weeks later, she showed me the bill that came in the mail for nearly $9,000. It broke my heart watching the tears roll down her cheek as she explained that she had no idea how she was going to be able to pay for the scan.

That experience was just the tip of the iceberg for millions of Americans who were devastated by the Wizard of Oz screen erected by various players in the healthcare industry. That same year, Edward Hanway, the outgoing CEO of Cigna, was given a parting gift of $110.9 million as a “retirement bonus.”

So when the Affordable Care Act began promoting “change,” I optimistically hoped that true, meaningful, and sensible reform policies would replace was was obviously a failing and inequitable system.

Unfortunately, as the actual details and true consequences of the ACA were made apparent, it quickly became clear that it amounted to a catalyst for an accelerated Medicaid expansion and very little else in terms of measurable results.

Since Medicaid costs already strained the budgets of most states nationwide, it was obvious more taxpayer subsidization would be required to cover those ballooning costs—rather than coming up with any strategies to actually curb the amount that we as a system were spending and (more often than not) wasting.

According to former Colorado Treasury Secretary Mark Hillman, “General fund spending on Medicaid grew from $1.15 billion in 2009-10 to $2.67 billion in 2016-17. And … total spending on the department that oversees Medicaid has grown to more than $9 billion—fully one third of all money spent by the State of Colorado.”

Not long after my patient showed me her CT scan bill, I had an idea that was quickly transformed into reality and led to the development of Colorado’s first Direct Primary Care (DPC) program and one of the first in the nation.

Since then, many DPCs have sprung up in virtually every state, offering what has turned out to be by far the single most powerful innovation for bending down the cost-curve of healthcare spending.

DPC programs routinely decrease total systemic healthcare costs for participants by 20 percent or more, while costs for most non-Medicaid recipients have continued going up.

While I hoped and believed this game changing cost saving would turn out to be true from the beginning, we now have data to prove it. DPC works. It is ideally suited to pair with a high-deductible major medical plan.

DPC plans typically cost $75-$150/month per person and cover 80-90 percent of most patients’ healthcare services ranging from well exams to skin cancer surgeries with no copays.

Most DPC patient-members also have 24/7 access to their personal physicians via cellphone, text messaging, and email, as well as nonstop, round-the-clock urgent care. All such services are provided with no copays.

This kind of access prevents DPC patient-members from going to the ER for anything except true life-threatening medical emergencies.

One ER visit for a few stitches usually costs more than a year of DPC membership for an entire family. Furthermore DPC providers seek out the most economical resources for ancillary tests, such as CT scans, which now only cost my patients $300, rather than the $9,000 in the example above.

Over the years, I have cared for many self-employed individuals as well as owners of small and medium-sized businesses with my DPC programs, typically with a dramatic improvement in patient satisfaction as well as cost savings to their companies.

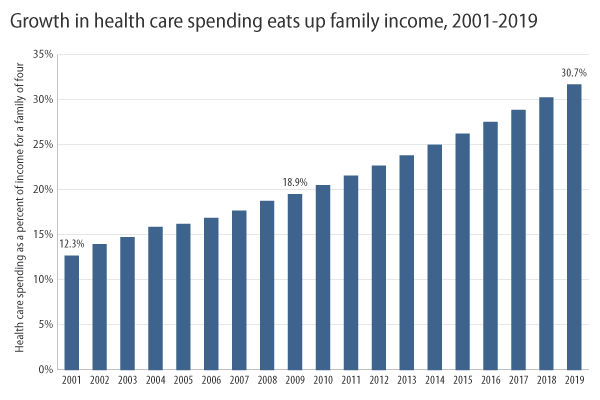

Unfortunately, many insurance companies continue to raise not just deductibles, but premiums as well, and this has created an untenable situation for those who we all acknowledge to be the engines of our economy.

Small and medium-sized businesses employ the greatest percentage of our nation’s workforce and should rightfully be the darlings of our local, state, and federal governments—and yet the opposite is too often true. They have, for decades, been bearing the brunt of unbridled health insurance premiums in an overly disproportionate manner.

Blue chip corporations can afford to subsidize employee health benefits because most are self-funded and command enormous influence over preferred contracted rates with various third parties. Large employers subsidize on average 70-80 percent of the healthcare premium for their employees.

Medicaid recipients pay almost nothing for their healthcare — nearly 100 percent subsidized by our government by way of taxes — and folks over 65 qualify for Medicare, which is also heavily subsidized by our government.

But those who are self-employed or own businesses with a few hundred employees or less have limited resources to turn to, and now they face stiff penalties if they fail to provide qualified healthcare plans to their workers at premiums which continue to rise. The very individuals who are bold enough to face the many challenges of entrepreneurship and work the longest hours in order to bootstrap a business are rewarded by premiums which now average around $1,500/mo for a family of four.

And if you work for a business of less than 50 employees, you are likely in the same boat. If you don’t qualify for subsidies on the health exchange, which many hard-working Americans don’t, what recourse do you have other than to pay this exorbitant premium, even if you are health conscious and rarely go to the doctor?

For most people the answer is “not much.” I recently spoke to a health insurance broker who lamented that she was struggling to find insurance plans for small businesses in our area for under $2,000/month per family. This is an outrage.

As Americans, we always have two options: Wait for something to change, or innovate. If there is a core value that pulses throughout Boulder County and unifies its residents, it is surely that of innovation.

So in the spirit of our outside-the-box community, we offer something different. Designed for health-conscious organizations and individuals, our Cloud Medical DPC program has joined forces with a non-profit provider of major medical coverage, and we have launched a comprehensive, ACA-exempt (no tax penalty!) plan that offers not only 24/7 primary care with unlimited visits and no copays, but also covers high-cost services like hospitalizations, surgeries, and maternity care.

This program kicks in at just $500 for individuals and $1,500 for families.

The monthly premiums for this comprehensive healthshare program combined with Cloud Medical DPC (Direct Primary Care) are usually less than half the price of anything you’ll find on the healthcare exchange.

So, if you’re one of the amazing Colorado-built companies that’s creating new and groundbreaking software, products, and services, and providing jobs for people who live in our magnificent state, we salute you.

Signup here, then complete the secure enrollment form.

More questions about Direct Primary Care compared to the old healthcare model? Don’t hesitate to call: